Are Scholarships Taxable?

Scholarships are not taxable income for most students. However, there are some exceptions to this rule.

In general, scholarships are considered tax-exempt if they are awarded based on academic merit, athletic ability, or other non-athletic achievements. Scholarships that are awarded based on financial need are not tax-exempt.

The amount of a scholarship that is tax-exempt depends on the type of scholarship and the student’s income. For example, scholarships that are awarded to students who are enrolled at least half-time are generally tax-exempt up to the amount of the student’s tuition and fees.

Students who receive scholarships that are not tax-exempt must report the amount of the scholarship as income on their tax return. The scholarship income is taxed at the student’s regular tax rate.

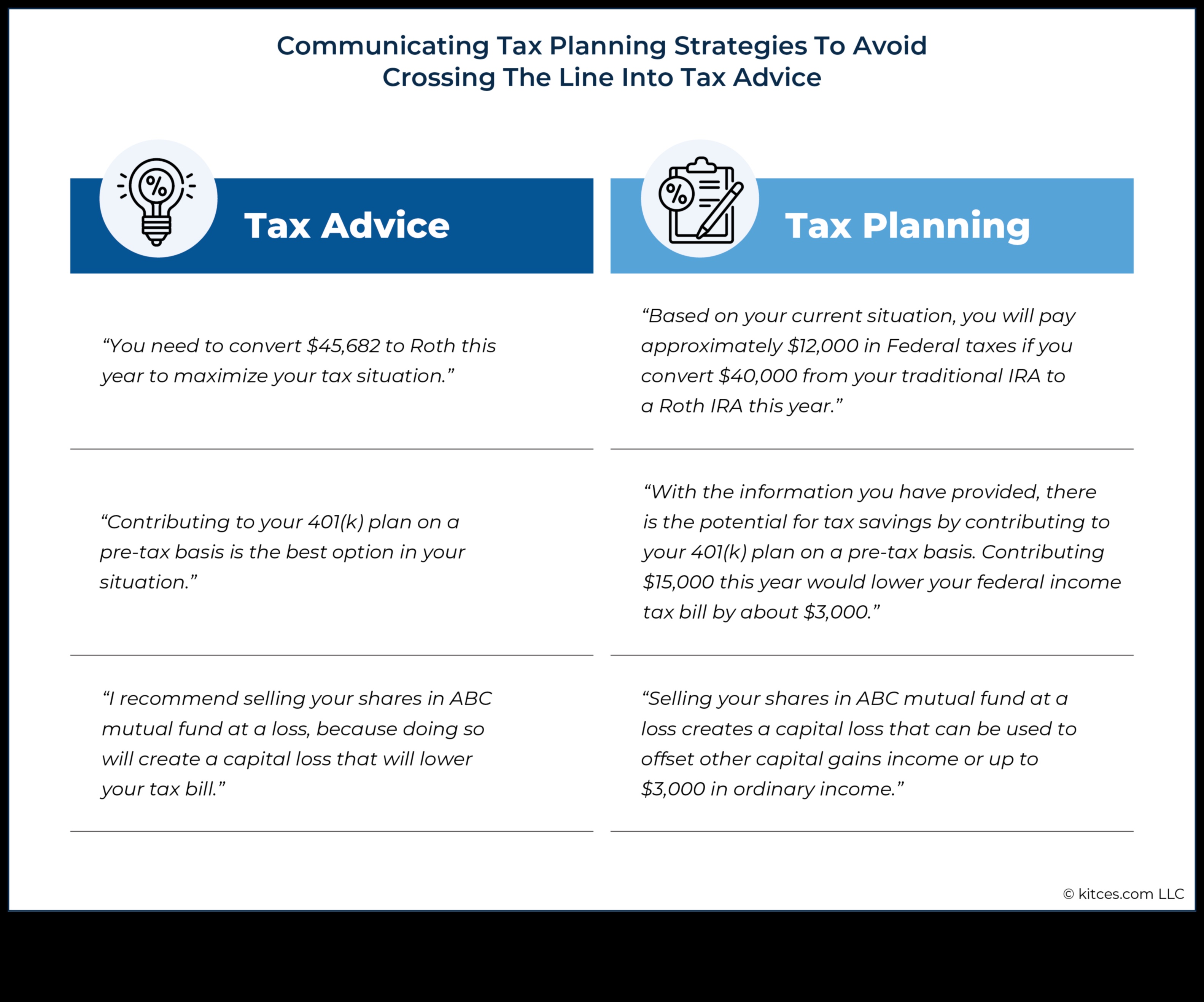

For more information on the tax implications of scholarships, please consult with a tax professional.

| Topic | Answer |

|---|---|

| Scholarship | A scholarship is a gift of money or other financial aid awarded to a student to help pay for their education. |

| Tax implications of scholarships | Scholarships are generally not taxable income, but there are some exceptions. |

| Who is eligible for a scholarship tax exemption? | Students who are enrolled in a degree program at an accredited college or university are eligible for a scholarship tax exemption. |

| How much of a scholarship is tax-exempt? | The amount of a scholarship that is tax-exempt depends on the type of scholarship and the student’s income. |

| When are scholarships taxed? | Scholarships are taxed when they are received. |

II. What is a scholarship?

A scholarship is a gift of money or other financial assistance awarded to a student to help them pay for their education. Scholarships are typically awarded based on academic merit, financial need, or a combination of the two.

III. Tax implications of scholarships

Scholarships are generally not taxable income, but there are some exceptions.

The most important exception is for scholarships that are awarded for tuition and fees. These scholarships are not taxable, even if they are paid directly to the student.

Other scholarships that may be tax-exempt include those that are awarded for room and board, books, or other educational expenses. However, these scholarships are only tax-exempt if they are awarded by a qualified educational institution.

Scholarships that are not tax-exempt are considered taxable income. This means that the student must include the amount of the scholarship in their taxable income and pay taxes on it.

The amount of tax that the student owes on a scholarship depends on their other income and filing status.

Who is eligible for a scholarship tax exemption?

In order to be eligible for a scholarship tax exemption, you must meet all of the following criteria:

- You must be a student.

- You must be enrolled at least half-time in a degree or certificate program at an eligible educational institution.

- The scholarship must be awarded for academic or athletic achievement.

- The scholarship must not be paid to you in exchange for services rendered.

If you meet all of these criteria, you may be eligible to receive a scholarship tax exemption. However, it is important to note that not all scholarships are tax-exempt. Some scholarships may be taxable, depending on the specific terms of the award.

How much of a scholarship is tax-exempt?

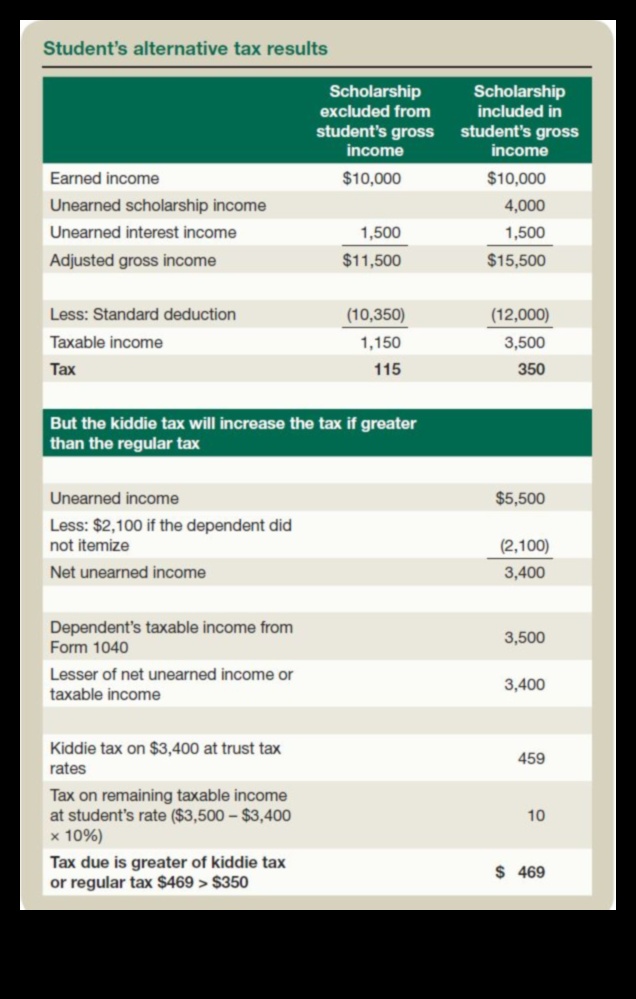

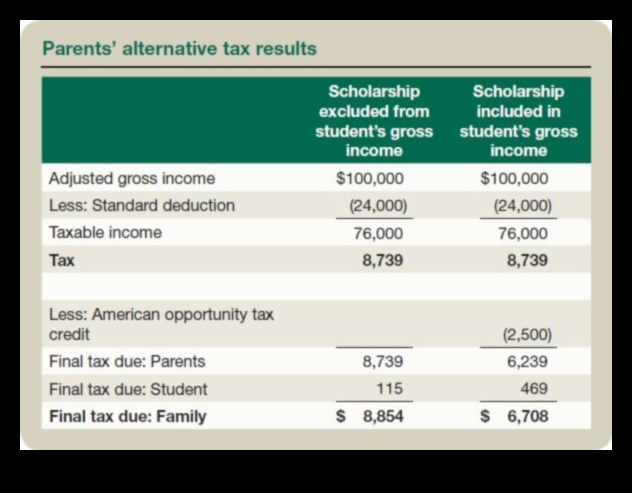

The amount of a scholarship that is tax-exempt depends on the type of scholarship and the student’s income.

For example, scholarships that are awarded for tuition, fees, books, and supplies are generally tax-exempt. However, scholarships that are awarded for room and board, transportation, or other personal expenses are taxable.

Additionally, scholarships that are awarded to students who are enrolled at least half-time are generally tax-exempt. However, scholarships that are awarded to students who are enrolled less than half-time are taxable.

Finally, the amount of a scholarship that is tax-exempt is also reduced by the student’s income. For example, if a student’s income is above a certain threshold, the student will have to pay taxes on a portion of their scholarship.

For more information on the tax implications of scholarships, please consult with a tax professional.

VI. When are scholarships taxed?

Scholarships are generally not taxed until the student uses them to pay for qualified expenses. Qualified expenses include tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution.

However, scholarships that are used to pay for room and board, personal expenses, or other non-qualified expenses are taxable.

The taxable amount of a scholarship is the amount that is used to pay for non-qualified expenses. For example, if a student receives a scholarship of $10,000 and uses $5,000 of it to pay for tuition and fees and $5,000 to pay for room and board, the taxable amount of the scholarship is $5,000.

Students who receive scholarships should be aware of the tax implications of their awards. They should consult with a tax professional to determine how their scholarships will be taxed.

VII. How are scholarships reported on your tax return?

Scholarships are reported on your tax return as taxable income unless they meet the criteria for an exemption. If you receive a scholarship that is not taxable, you will not need to report it on your tax return. If you receive a scholarship that is taxable, you will need to report it as income on your tax return. The amount of income you report will depend on the type of scholarship you received.

For example, if you receive a scholarship that is used to pay for tuition and fees, you will not have to report any of the scholarship as income. However, if you receive a scholarship that is used to pay for room and board or other living expenses, you will need to report the amount of the scholarship that is used for those expenses as income.

You can find more information about how to report scholarships on your tax return on the IRS website.

Scholarship tax implications for international students

International students who receive scholarships may be subject to different tax rules than U.S. citizens and permanent residents. In general, scholarships that are awarded for tuition, fees, books, and supplies are not taxable. However, scholarships that are awarded for room and board, personal expenses, or travel may be taxable.

The amount of a scholarship that is taxable depends on the student’s status as a U.S. resident or nonresident alien. U.S. resident aliens are taxed on all income, including scholarships, that is earned in the United States. Nonresident aliens are taxed only on income that is effectively connected with a U.S. trade or business.

If you are an international student and you are unsure whether your scholarship is taxable, you should consult with a tax advisor.

IX. FAQs

1. Are all scholarships taxable?

No, not all scholarships are taxable. Only scholarships that are considered to be “taxable scholarships” are taxed. Taxable scholarships are scholarships that are awarded for educational expenses and that are not required to be repaid.

2. What are the criteria for a scholarship to be considered taxable?

A scholarship is considered taxable if it meets all of the following criteria:

* It is awarded for educational expenses.

* It is not required to be repaid.

* It is not a gift.

3. What are some examples of taxable scholarships?

Some examples of taxable scholarships include:

* Scholarships awarded by colleges and universities.

* Scholarships awarded by private organizations.

* Scholarships awarded by employers.

4. What are some examples of non-taxable scholarships?

Some examples of non-taxable scholarships include:

* Scholarships awarded by the government.

* Scholarships awarded by charitable organizations.

* Scholarships awarded to students with disabilities.

5. How are taxable scholarships taxed?

Taxable scholarships are taxed as ordinary income. This means that they are taxed at the same rate as your other income.

6. When are taxable scholarships taxed?

Taxable scholarships are taxed in the year that you receive them.

7. How are taxable scholarships reported on your tax return?

Taxable scholarships are reported on Form 1040, Schedule 1.

8. What are the tax implications of scholarships for international students?

The tax implications of scholarships for international students vary depending on their immigration status. International students who are considered to be nonresident aliens for tax purposes are not taxed on scholarships that are used to pay for their tuition and fees. However, international students who are considered to be resident aliens for tax purposes are taxed on all scholarships, regardless of how they are used.

9. What are some other resources that I can use to learn more about the taxation of scholarships?

Some other resources that you can use to learn more about the taxation of scholarships include:

* The IRS website: https://www.irs.gov/publications/p970

* The College Board website: https://www.collegeboard.org/tax-information-for-students

* The American Bar Association website: https://www.americanbar.org/groups/taxation/publications/tax-lawyers-guide-to-financial-aid/

Are Scholarships Taxable?

Scholarships are not taxable income in most cases. However, there are some exceptions to this rule. This article will discuss the tax implications of scholarships, including who is eligible for a scholarship tax exemption, how much of a scholarship is tax-exempt, when scholarships are taxed, and how scholarships are reported on your tax return.

FAQs

Q: Are scholarships taxable?

A: In most cases, scholarships are not taxable income. However, there are some exceptions to this rule. For example, scholarships that are used to pay for room and board are taxable.

Q: Who is eligible for a scholarship tax exemption?

A: Students who are enrolled in a degree program at an accredited institution are eligible for a scholarship tax exemption. Students who are enrolled in a non-degree program or who are not enrolled in school are not eligible for a scholarship tax exemption.

Q: How much of a scholarship is tax-exempt?

A: The amount of a scholarship that is tax-exempt depends on how the scholarship is used. Scholarships that are used to pay for tuition, fees, books, and supplies are tax-exempt. Scholarships that are used to pay for room and board are taxable.